Member-only story

Barbarians At The Gates of Software Development

When Money Trumps logic

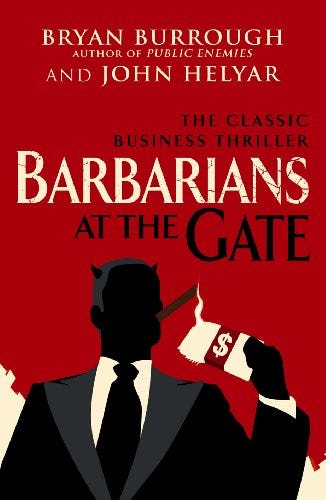

Barbarians at the Gate: The Fall of RJR Nabisco is a book about the biggest leveraged buyout (LBO) in history of RJR Nabisco in 1989 and the story of greed and madness that followed. Read about it on Wiki — Barbarians at the gate.

The bidding for software projects can be equally as insane, often creating estimates of time/money that are impossible. Rarely is the winning bid how long it will take to create the software.

What is a leveraged buyout?

A Leveraged buy out is when a company is purchased with money borrowed on the assets of the company they are going to buy

“A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company.” Leveraged Buyout (LBO)

An example is Man Utd football club. The Glazers borrowed the money based on the value of Man Utd…